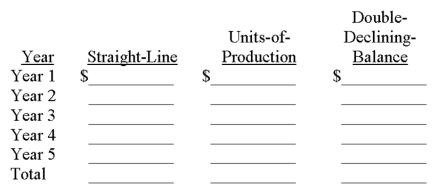

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a salvage value of $75,000). During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Correct Answer:

Verified

Q151: On April 1,Year 5 a company discarded

Q160: A company purchased a machine for $75,000

Q160: A company purchased a heating system on

Q161: A company purchased land with a building

Q161: Heidel Co. paid $750,000 cash to buy

Q163: A company purchased a special purpose machine

Q164: A company purchased land on which to

Q166: A company had net sales of $230,000

Q167: Mahoney Company had the following transactions involving

Q170: Prepare journal entries to record the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents