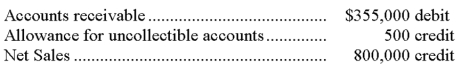

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

A) $1,275

B) $1,775

C) $4,500

D) $4,800

E) $5,500

Correct Answer:

Verified

Q84: Teller purchased merchandise from TechCom on October

Q85: MixRecording Studios purchased $7,800 in electronic components

Q87: Darby uses the allowance method to account

Q88: Electron borrowed $75,000 cash from TechCom by

Q90: Teller purchased merchandise from TechCom on October

Q91: On December 31 of the current year,

Q93: MixRecording Studios purchased $7,800 in electronic components

Q109: Explain how to record the receipt of

Q117: On November 19, Hayes Company receives a

Q120: On August 9, Pierce Company receives a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents