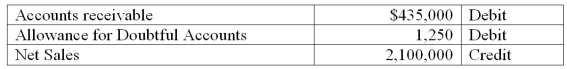

A company uses the percent of receivables method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 3.5% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 3.5% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

A) Debit Bad Debts Expense $13,975; credit Allowance for Doubtful Accounts $13,975.

B) Debit Bad Debts Expense $15,225; credit Allowance for Doubtful Accounts $15,225.

C) Debit Bad Debts Expense $16,475; credit Allowance for Doubtful Accounts $16,475.

D) Debit Bad Debts Expense $7,350; credit Allowance for Doubtful Accounts $7,350.

E) Debit Bad Debts Expense $17,350; credit Allowance for Doubtful Accounts $17,350.

Correct Answer:

Verified

Q102: What is the accounts receivable turnover ratio?

Q103: A company allows its customers to use

Q110: On September 1, a customer's account balance

Q129: What is the amount of interest that

Q130: Explain the basic difference between estimating the

Q135: All of the following statements regarding recognition

Q136: Hasbro had net sales of $7,875 and

Q141: A company reports the following results in

Q143: Tecom accepts the NOVA credit card for

Q152: Describe how accounts receivable arise and how

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents