Following are seven items a through g that would cause Xavier Company's book balance of cash to differ from its bank statement balance of cash.

a. A service charge imposed by the bank.

b. A check listed as outstanding on the previous period's reconciliation and still outstanding at the end of this month.

c. A customer's check returned by the bank is marked "Not Sufficient Funds(NSF)".

d. A deposit that was mailed to the bank on the last day of the current month and is unrecorded on this month's bank statement.

e. A check paid by the bank at its correct $190 amount was recorded in error in the company's Check Register at $109.

f. An unrecorded credit memorandum indicated that bank had collected a note receivable for Xavier Company and deposited the proceeds in the company's account.

g. A check was written in the current period that is not yet paid or returned by the bank.

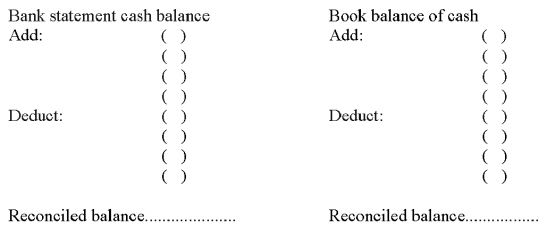

Indicate where each item a through g would appear on Xavier Company's bank reconciliation by placing its identifying letter in the parentheses in the proper section of the form below.

Correct Answer:

Verified

Q142: The following information is available for the

Q144: At the end of the current period,

Q146: For each of the independent cases below,

Q150: A company reported net sales for Year

Q151: Discuss the purpose of a bank reconciliation.

Q152: On November 1, a company established a

Q152: A company established a $400 petty cash

Q155: What is the purpose of the petty

Q159: On August 17, at the end of

Q163: The treasurer of a company is responsible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents