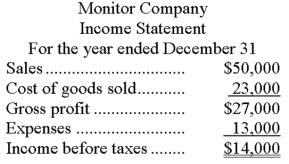

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for its first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had the company used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been, had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

c. If Monitor wanted to lower the amount of income taxes to be paid, which method would it choose?

Correct Answer:

Verified

Q129: What is the effect of an error

Q147: A company made the following merchandise purchases

Q147: Explain the difference between the retail inventory

Q150: A company made the following purchases during

Q150: Advances in technology have greatly reduced the

Q155: A company reported the following data:

Q156: A company made the following merchandise purchases

Q187: Sarbanes Oxley (SOX) demands that companies safeguard

Q188: Discuss the important accounting features of a

Q191: Explain why the lower of cost or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents