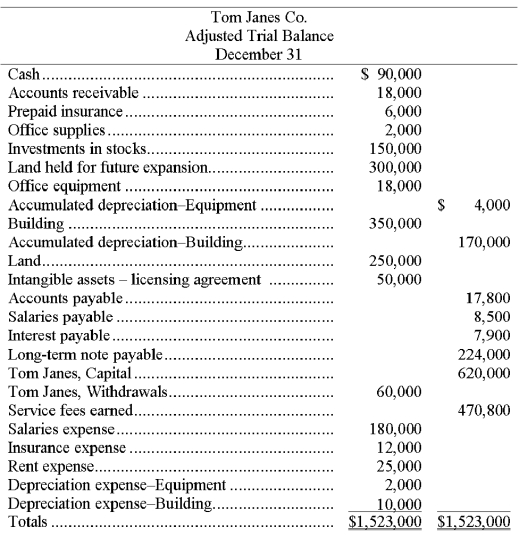

The following year-end adjusted trial balance is for Tom Janes Co. at the end of December 31. The credit balance in Tom Janes, Capital at the beginning of the year, January 1, was $320,000. The owner, Tom Janes, invested an additional $300,000 during the current year. The land held for future expansion was also purchased during the current year.  Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

Required: 1. Prepare a classified year-end balance sheet. (Note: A $22,000 installment on the long-term note payable is due within one year.)

2. Using the information presented:

(a) Calculate the current ratio. Comment on the ability of Tom Janes Co. to meets its short-term debts.

(b) Calculate the debt ratio and comment on the financial position and risk analysis of Tom Janes Co.

(c) Using the account balances to analyze the financial position of Tom Janes Co., why would the owner need to invest an additional $300,000 in the business when the business is already profitable and the owner had an existing capital balance of $320,000?

Correct Answer:

Verified

Q67: Which of the following statements regarding reporting

Q127: Journalizing and posting closing entries is a

Q135: Bentley records adjusting entries at its December

Q138: A company had revenues of $187,000 and

Q142: Based on the adjusted trial balance shown

Q143: The adjusted trial balance of the Thomas

Q144: Calculate the current ratio in each of

Q145: Explain the difference between temporary and permanent

Q145: The summary amounts below appear in the

Q146: Use the following partial work sheet from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents