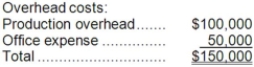

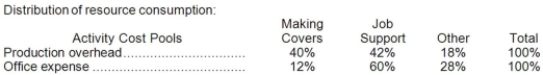

Phoenix Company makes custom covers for air conditioning units for homes and businesses. The company uses an activity-based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The amount of activity for the year is as follows:  Required:

Required:

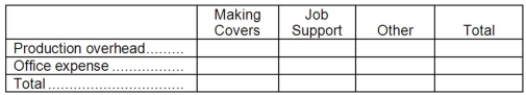

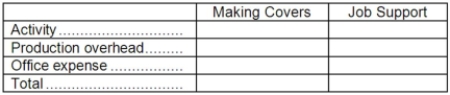

a. Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in the table below:  b. Compute the activity rates (i.e., cost per unit of activity) for the Making Awnings and Job Support activity cost pools by filling in the table below:

b. Compute the activity rates (i.e., cost per unit of activity) for the Making Awnings and Job Support activity cost pools by filling in the table below:  c. Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1,500. The sales revenue from this job is $2,500.

c. Prepare an action analysis report in good form of a job that involves making 50 yards of covers and has direct materials and direct labor cost of $1,500. The sales revenue from this job is $2,500.

For purposes of this action analysis report, direct materials and direct labor should be classified as a Green cost; production overhead as a Red cost; and office expense as a Yellow cost.

Correct Answer:

Verified

Q6: Jackson Painting paints the interiors and exteriors

Q7: To the nearest whole dollar, how much

Q8: An action analysis report reconciles activity-based costing

Q9: Suppose an action analysis report is prepared

Q10: According to the activity-based costing system, what

Q11: Suppose an action analysis report is prepared

Q12: Hasty Hardwood Floors installs oak and other

Q14: If a cost object such as a

Q15: Ingersol Draperies makes custom draperies for homes

Q16: Goel Company, a wholesale distributor, uses activity-based

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents