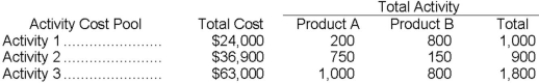

Lindsey Company uses activity-based costing. The company has two products: A and B. The annual production and sales of Product A is 5,000 units and of Product B is 2,000 units. There are three activity cost pools, with total cost and activity as follows:  The activity-based costing cost per unit of Product A is closest to:

The activity-based costing cost per unit of Product A is closest to:

A) $14.11

B) $13.77

C) $7.00

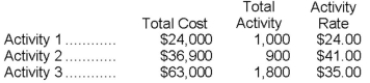

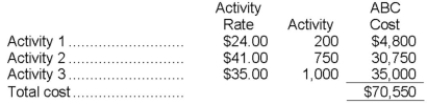

D) $17.70 The activity rates for each activity cost pool are computed as follows: The overhead cost charged to Product A is:

The overhead cost charged to Product A is: Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Cost per unit = $70,550 ÷ 5,000 units = $14.11 per unit

Correct Answer:

Verified

Q36: Hochberg Corporation uses an activity-based costing system

Q37: Which of the following levels of costs

Q38: Which terms would make the following sentence

Q39: Activity rates are computed in the second-stage

Q40: Grandolfo Corporation uses an activity-based costing system

Q42: Moyle Corporation has provided the following data

Q43: How much supervisory wages and salaries and

Q44: Laguna Corporation has provided the following data

Q45: How much indirect factory wages and factory

Q46: Bera Corporation uses the following activity rates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents