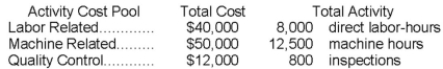

Swagg Jewelry Corporation manufactures custom jewelry. In the past, Swagg has been using a traditional overhead allocation system based solely on direct labor-hours. Sensing that this system was distorting costs and selling prices, Swagg has decided to switch to an activity-based costing system using three activity cost pools. Information on these activity cost pools are as follows:  Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Job #309 incurred $900 of direct material, 30 hours of direct labor at $40 per hour, 80 machine hours, and 5 inspections.

Required:

a. What is the cost of the job under the activity-based costing system?

b. Relative to the activity-based costing system, would Job #309 have been overcosted or undercosted under the traditional system and by how much?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: The activity rate under the activity-based costing

Q118: What is the overhead cost assigned to

Q119: What is the product margin for Product

Q120: What is the overhead cost assigned to

Q121: Vassallo Corporation's activity-based costing system has three

Q123: Fife & Jones PLC, a consulting firm,

Q124: Flyer Corporation manufactures two products, Product A

Q125: The following data have been provided by

Q126: Brannum Corporation has provided the following data

Q127: Schulenburg Corporation has provided the following data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents