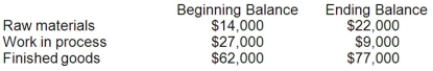

Bakerston Company is a manufacturing firm that uses job-order costing. The company's inventory balances were as follows at the beginning and end of the year:  The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours. At the beginning of the year, the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost. The following transactions were recorded for the year:

• Raw materials were purchased, $315,000.

• Raw materials were requisitioned for use in production, $307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred: direct labor, $377,000; indirect labor, $96,000; and administrative salaries, $172,000.

• Selling costs, $147,000.

• Factory utility costs, $10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling, general, and administrative activities.

• Manufacturing overhead was applied to jobs. The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a. Prepare a schedule of cost of goods manufactured.

b. Was the overhead underapplied or overapplied? By how much?

c. Prepare an income statement for the year. The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q151: During December, Deller Corporation purchased $79,000 of

Q152: The journal entry to record the allocation

Q153: Maggie Manufacturing Company applies manufacturing overhead to

Q154: Huckeby Corporation bases its predetermined overhead rate

Q155: Christofferse Corporation bases its predetermined overhead rate

Q157: The cost of goods sold for July

Q158: During December, Mccroskey Corporation incurred $66,000 of

Q159: Quark Spy Equipment manufactures espionage equipment. Quark

Q160: Allenton Company is a manufacturing firm that

Q161: Evener Inc. has provided the following data

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents