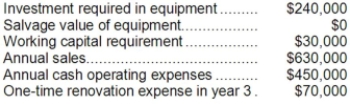

The following information concerning a proposed capital budgeting project has been provided by Wick Corporation:  The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

The expected life of the project is 4 years. The income tax rate is 35%. The after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment and the annual depreciation expense would be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net present value of the project is closest to:

A) $101,282

B) $224,850

C) $119,042

D) $266,500

Correct Answer:

Verified

Q13: Gayheart Corporation is considering a capital budgeting

Q14: The investment in working capital at the

Q15: Bosell Corporation has provided the following information

Q16: Alopecia Hair Tonic Corporation is considering an

Q17: Unless the organization is tax-exempt, income taxes

Q19: Milliner Corporation has provided the following information

Q20: Rieben Corporation is considering a capital budgeting

Q21: Leamon Corporation is considering a capital budgeting

Q22: Gutshall Corporation is considering a capital budgeting

Q23: Santistevan Corporation has provided the following information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents