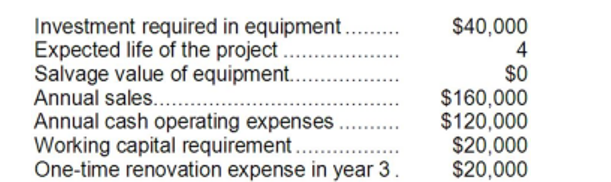

Shinabery Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

A) $39,675

B) $68,280

C) $25,515

D) $65,000

Correct Answer:

Verified

Q74: Skolfield Corporation is considering a capital budgeting

Q75: Foucault Corporation has provided the following information

Q76: Credit Corporation has provided the following information

Q77: Foucault Corporation has provided the following information

Q78: Kostka Corporation is considering a capital budgeting

Q80: Credit Corporation has provided the following information

Q81: Gouker Corporation has provided the following information

Q82: Erling Corporation has provided the following information

Q83: Battaglia Corporation is considering a capital budgeting

Q84: Zangari Corporation has provided the following information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents