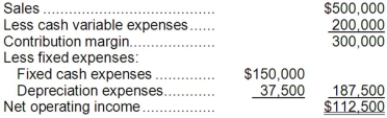

(Ignore income taxes in this problem.) Harrison Corporation is studying a project that would have an eight-year life and would require a $300,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project:  The company's required rate of return is 10%. The payback period for this project is closest to:

The company's required rate of return is 10%. The payback period for this project is closest to:

A) 3 years

B) 2 years

C) 2.5 years

D) 2.67 years

Correct Answer:

Verified

Q11: In capital budgeting computations, discounted cash flow

Q28: The project profitability index is computed by

Q29: Which of the following will have the

Q31: (Ignore income taxes in this problem.) Buy-Rite

Q32: When making preference decisions about competing investment

Q34: The simple rate of return method does

Q35: The net present value of a proposed

Q36: If a project does not have constant

Q37: The net present value and internal rate

Q38: If the project profitability index of an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents