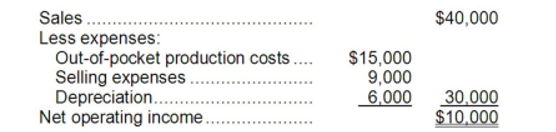

(Ignore income taxes in this problem.) Pro-Mate, Inc. is a producer of athletic equipment. The company is considering the purchase of a machine to produce baseball bats. The machine will cost $60,000 and have a 10-year useful life. The following annual revenues and expenses are projected:

The machine will have no salvage value. Assume cash flows occur uniformly throughout a year except for the initial investment.

-The payback period for the new machine is about:

A) 6.0 years

B) 1.5 years

C) 5.4 years

D) 3.75 years

Correct Answer:

Verified

Q105: (Ignore income taxes in this problem.) Chee

Q106: (Ignore income taxes in this problem.) Carlson

Q107: (Ignore income taxes in this problem.) The

Q108: (Ignore income taxes in this problem.) Pro-Mate,

Q109: (Ignore income taxes in this problem.) The

Q111: (Ignore income taxes in this problem.) Jimba's,

Q112: (Ignore income taxes in this problem.) The

Q113: (Ignore income taxes in this problem.) The

Q114: (Ignore income taxes in this problem.) Overland

Q115: (Ignore income taxes in this problem.) Chee

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents