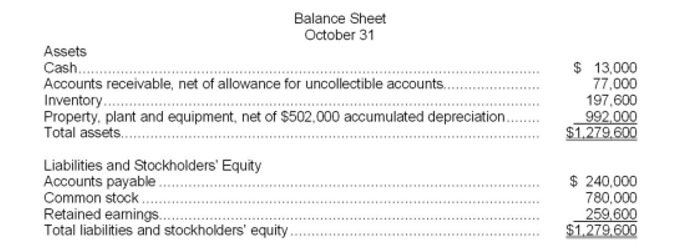

Carter Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow:

• Sales are budgeted at $380,000 for November, $390,000 for December, and $400,000 for January.

• Collections are expected to be 70% in the month of sale, 27% in the month following the sale, and 3% uncollectible.

• The cost of goods sold is 65% of sales.

• The company desires to have an ending merchandise inventory equal to 80% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase.

• Other monthly expenses to be paid in cash are $22,000.

• Monthly depreciation is $20,000.

• Ignore taxes.

-The net income for December would be:

A) $114,500

B) $94,500

C) $101,400

D) $82,800

Correct Answer:

Verified

Q155: Bredder Supply Corporation manufactures and sells cotton

Q156: The following information is budgeted for McCracken

Q157: Carter Lumber sells lumber and general building

Q158: Rogers Corporation is preparing its cash budget

Q159: The Adams Corporation, a merchandising firm, has

Q161: The manufacturing overhead budget of Paparella Corporation

Q162: Chow Corporation manufactures children's chairs made of

Q163: The selling and administrative expense budget of

Q164: Kouba Corporation is working on its direct

Q165: Freet Inc. is preparing its cash budget

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents