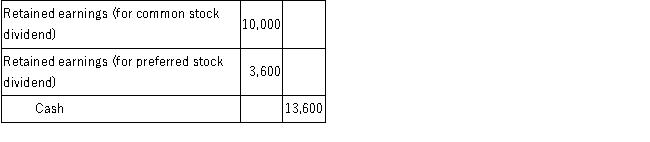

During 2017, Sanders Corporation prepared the following journal entry to record the declaration and payment of a cash dividend:  The total par values of common and preferred stock outstanding were $55,000 and $40,000, respectively. No dividends were declared or paid during 2016.

The total par values of common and preferred stock outstanding were $55,000 and $40,000, respectively. No dividends were declared or paid during 2016.

There are 7,500 shares of common stock held in treasury.

The common stock has a par value of $2 per share.

Required:

A.If the preferred stock is noncumulative, calculate the current dividend rate on the preferred stock.

B.Calculate the number of common stock shares that received dividends.

C.Calculate the dividend paid per share of common stock.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Which of the following statements is not

Q120: Date on which the board of directors

Q121: Tractor Corporation was just formed. The following

Q122: Wedge Corporation has the following capital stock

Q123: On January 1, 2016, the accounts of

Q123: Determine the effect of the following transactions

Q126: DRP, Inc. issued 50,000 shares of its

Q127: On January 1, 2016, the stockholders' equity

Q128: For the listed items below, identify the

Q129: The board of directors of Atlantic Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents