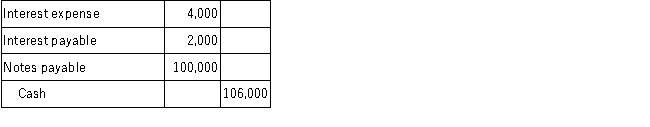

Melanie Corp. borrowed $100,000 cash on September 1, 2016, and signed a one-year 6%, interest-bearing note payable. The interest and principal are both due on August 31, 2017. Assume that the appropriate adjusting entry was made on December 31, 2016 and that no adjusting entries have been made during 2017. Which of the following would be the required journal entry to pay the note on August 31, 2017?

A)

B)

C)

D)

Correct Answer:

Verified

Q44: Which of the following best describes the

Q47: Mission Corp. borrowed $50,000 cash on April

Q49: Phipps Company borrowed $25,000 cash on October

Q50: Mission Corp. borrowed $50,000 cash on April

Q52: Which of the following statements incorrectly describes

Q53: Miranda Company borrowed $100,000 cash on September

Q54: Purdum Farms borrowed $10 million by signing

Q55: Thomas Company decided to borrow $30,000 on

Q56: Failure to make a necessary adjusting entry

Q58: Which of the following transactions will decrease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents