Four transactions described below were completed during 2016 by Russell Company. The books are adjusted only at year-end.

A.On December 31, 2016, Russell Company owed employees $3,750 for wages that were earned by them during December and were not recorded.

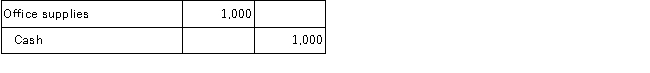

B.During 2016, Russell Company purchased office supplies that cost $1,000, which were placed in the supplies room for use as needed.The purchase was recorded as follows:

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

At January 1, 2016, the amount of unused office supplies was $300.At December 31, 2016, a physical count showed unused office supplies in the supply room amounting to $100.

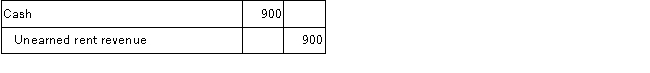

C.On December 1, 2016, Russell Company rented some office space to another party.Russell Company collected $900 rent for the period December 1, 2016, to March 1, 2016.The December 1 transaction was recorded as follows:

D.On July 1, 2016, Russell Company borrowed $12,000 cash on a one-year, 8% interest-bearing, note payable.The interest is payable on the due date of the note, June 30, 2017.The borrowing was recorded as follows on July 1, 2016:

Correct Answer:

Verified

Q101: Which of the following accounts requires a

Q102: Which of the following correctly describes the

Q106: On December 31, 2016, Madison Company prepared

Q107: For each of the following accounts you

Q112: On November 1, 2016, Bruce Company leased

Q114: Center Company is completing the accounting cycle

Q115: A list of the accounts of Medford

Q116: Describe the adjusted trial balance.

Q116: Below are two related transactions for Golden

Q117: What are the purposes of closing entries?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents