Three transactions described below were completed during 2016 by Story Company.

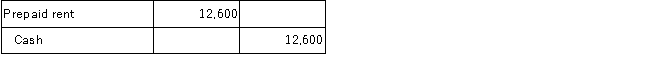

A.On June 1, 2016, Story Company paid $12,600 for one year's rent beginning on that date.The rent payment was recorded as follows:

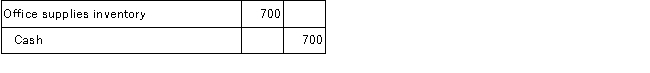

B.On February 1, 2016, Story Company purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed.The purchase was recorded as follows:

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

At December 31, 2016, a count showed unused office supplies of $200 in the storeroom.There was no beginning inventory of supplies on hand.

C.On December 31, 2016, Story Company owed employees $2,000 for wages earned during December.These wages had not been paid or recorded.Required:

Prepare the adjusting entries as of December 31, 2016, assuming no adjusting entries have been made during the year.

Correct Answer:

Verified

Q84: Which of the following best describes the

Q99: Top Company's 2016 sales revenue was $200,000

Q100: A trial balance prepared after the closing

Q101: On December 1, 2016, Fleet Company paid

Q102: Which of the following accounts would not

Q102: Which of the following correctly describes the

Q103: What is the purpose of adjusting entries?

Q105: Lane Company is completing the accounting cycle

Q106: On December 31, 2016, Madison Company prepared

Q107: For each of the following accounts you

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents