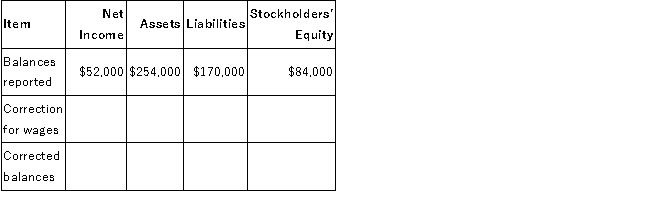

On December 31, 2016, Madison Company prepared an income statement and a balance sheet. In preparing the adjusting entries at year-end, Madison failed to record the adjusting entry for wages earned by employees, but not yet paid, amounting to $5,000 for the last four days of the year. The income statement reported net income of $52,000. The balance sheet reported total assets of $254,000, total liabilities of $170,000, and stockholders' equity of $84,000.

Required:

Complete the following tabulation to show the correct amounts for the financial statements (ignore income taxes).

Correct Answer:

Verified

Q101: On December 1, 2016, Fleet Company paid

Q101: Which of the following accounts requires a

Q102: Which of the following accounts would not

Q102: Which of the following correctly describes the

Q103: What is the purpose of adjusting entries?

Q103: Three transactions described below were completed during

Q105: Lane Company is completing the accounting cycle

Q107: For each of the following accounts you

Q111: Four transactions described below were completed during

Q117: What are the purposes of closing entries?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents