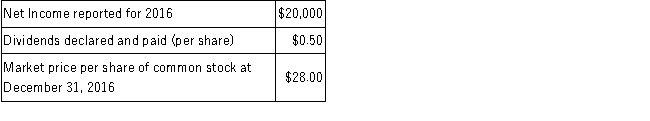

On January 1, 2016, Presto Corporation purchased, as a long-term investment, 5,000 shares of the outstanding voting common stock of Shazam Corporation at $30 per share. During 2016, the following events occurred at Shazam Corporation:  Required:

Required:

A. Prepare the journal entry for Presto Corporation to record the investment (use an account titled "Long-term investment").

B. Assume two independent situations, Case A for 5,000 shares as 10% ownership and Case B for 5,000 shares as 40% ownership. For each situation, prepare the following entries:

1. To recognize net income for 2016.

2. To record cash dividend declared and received.

3. To record any adjustment to market price of stock at year-end.

A.Prepare the journal entry for Presto Corporation to record the investment (use an account titled "Long-term investment").

B.Assume two independent situations, Case A for 5,000 shares as 10% ownership and Case B for 5,000 shares as 40% ownership.For each situation, prepare the following entries:

1.To recognize net income for 2016.2.To record cash dividend declared and received.3.To record any adjustment to market price of stock at year-end.

Correct Answer:

Verified

Q101: Orleans Corporation purchased 1,000,000 shares of Creole

Q103: On March 1, 2017, Young Company paid

Q104: On January 1, 2016, Alden Company acquired

Q105: On January 2, 2016, Eagle Company acquired

Q107: On January 31, 2016, McBurger Corporation purchased

Q108: During 2016, the following items were reported

Q109: On January 1, 2016, Fall Corporation acquired

Q110: As a long-term investment, Martha Company purchased

Q111: Required:

A.Discuss the criteria for applying the equity

Q113: Discuss how the equity method of accounting

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents