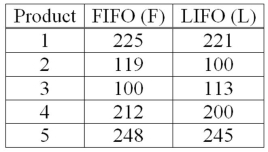

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  What is the decision at the 5% level of significance?

What is the decision at the 5% level of significance?

A) Fail to reject the null hypothesis and conclude LIFO is more effective.

B) Reject the null hypothesis and conclude LIFO is more effective.

C) Reject the alternate hypothesis and conclude LIFO is more effective.

D) Fail to reject the null hypothesis.

Correct Answer:

Verified

Q24: The purpose of pooling the sample proportions

Q55: If we are testing for the difference

Q59: When testing the hypothesized equality of two

Q60: The pooled estimate of the proportion is

Q62: If samples taken from two populations are

Q63: When testing for a difference between the

Q65: Accounting procedures allow a business to evaluate

Q68: A company is researching the effectiveness of

Q72: If we are testing for the difference

Q73: In one class, a statistics professor wants

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents