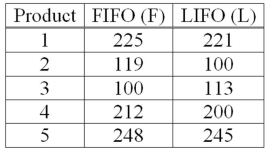

Accounting procedures allow a business to evaluate its inventory costs based on two methods: LIFO (Last In First Out) or FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $000s) for five products with the LIFO and FIFO methods. To analyze the difference, they computed (FIFO - LIFO) for each product. Based on the following results, does the LIFO method result in a lower cost of inventory than the FIFO method?  This example is what type of test?

This example is what type of test?

A) A one-sample test of means.

B) A two-sample test of means.

C) A paired t-test.

D) A test of proportions.

Correct Answer:

Verified

Q24: The purpose of pooling the sample proportions

Q55: If we are testing for the difference

Q63: When testing for a difference between the

Q71: The paired t test is especially appropriate

Q76: Accounting procedures allow a business to evaluate

Q77: A company is researching the effectiveness of

Q78: If a hypothesis states that one population

Q80: Accounting procedures allow a business to evaluate

Q97: If we are testing for the difference

Q176: A committee that is studying employer-employee relations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents