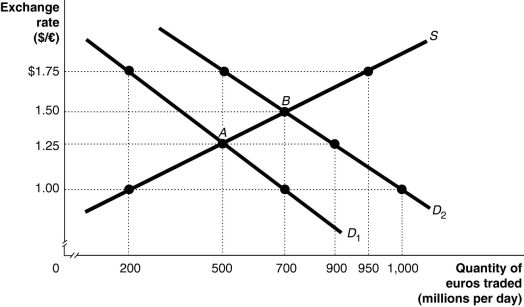

Figure 30-8

-Refer to Figure 30-8.The equilibrium exchange rate is at A,$1.25/euro.Suppose the European Central Bank pegs its currency at $1.00/euro.Speculators expect that the value of the euro will rise and this shifts the demand curve for euro to D2.After the shift

A) there is a shortage of euros equal to 1,000 million.

B) there is a surplus of euros equal to 400 million.

C) there is a shortage of euros equal to 800 million.

D) there is a surplus of euros equal to 500 million.

Correct Answer:

Verified

Q134: All of the following are considered among

Q135: All of the following explain why purchasing

Q136: Figure 30-6 Q136: A Big Mac costs $4.79 in the Q137: The "Big Mac Theory of Exchange Rates" Q144: If a country's currency _ the dollar,its Q147: Figure 30-7 Q153: During the Chinese experience with pegging the Q155: Figure 30-7 Q156: Figure 30-7 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()