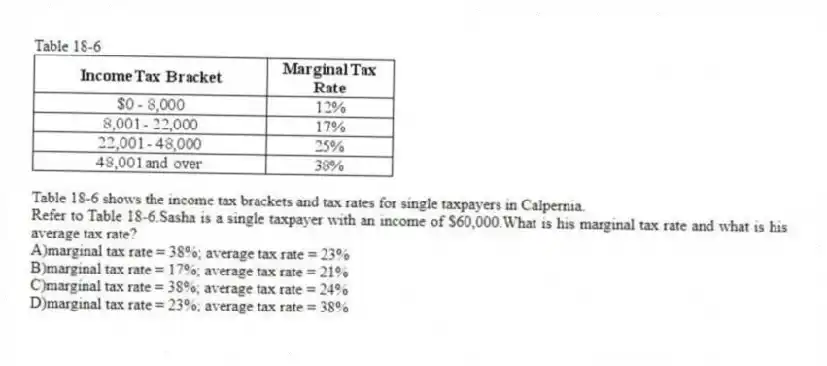

Table 18-6

Table 18-6 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-6.Sasha is a single taxpayer with an income of $60,000.What is his marginal tax rate and what is his average tax rate?

A) marginal tax rate = 38%; average tax rate = 23%

B) marginal tax rate = 17%; average tax rate = 21%

C) marginal tax rate = 38%; average tax rate = 24%

D) marginal tax rate = 23%; average tax rate = 38%

Correct Answer:

Verified

Q83: A tax bracket is

A)the percent of taxable

Q84: The "ability-to-pay" principle of taxation is the

Q85: Table 18-6 Q86: If the marginal tax rate is less Q87: The idea that two taxpayers in the Q89: If the marginal tax rate is equal Q90: Policymakers focus on marginal tax rate changes Q91: All of the following occur whenever a Q92: The largest percentage of federal income tax Q93: The federal corporate income tax is

![]()

A)regressive.

B)proportional.

C)progressive.

D)unfair.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents