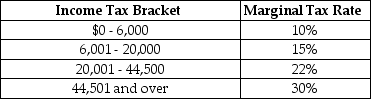

Table 18-9

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.Calculate the income tax paid by Sylvia, a single taxpayer with an income of $70,000.

A) $21,000

B) $15,740

C) $15,400

D) $13,475

Correct Answer:

Verified

Q122: An income tax system is _ if

Q130: In the United States, the federal income

Q132: Table 18-8 Q133: Suppose the government wants to finance housing Q135: When considering changes in tax policy, economists Q139: According to the horizontal-equity principle of taxation, Q143: According to the benefits-received principle, those who Q145: Describe each of the principles governments consider Q149: Suppose, on average, a family in Church Q156: Exempting food purchases from sales tax is

![]()

A)individuals

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents