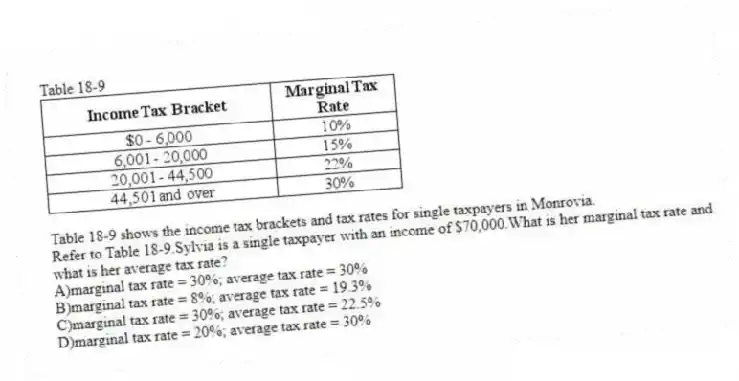

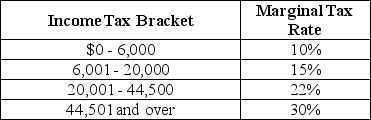

Table 18-9

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.Sylvia is a single taxpayer with an income of $70,000.What is her marginal tax rate and what is her average tax rate?

A) marginal tax rate = 30%; average tax rate = 30%

B) marginal tax rate = 8%; average tax rate = 19.3%

C) marginal tax rate = 30%; average tax rate = 22.5%

D) marginal tax rate = 20%; average tax rate = 30%

Correct Answer:

Verified

Q116: Which of the following is the source

Q117: In the United States, the largest source

Q118: Table 18-7 Q119: A tax imposed by a state or Q120: In 2016, over 75 percent of the Q122: An income tax system is _ if Q123: The excess burden of a tax Q124: The marginal tax rate is Q125: The average tax rate is calculated as Q126: According to the ability-to-pay principle of taxation

![]()

A)measures the

A)the amount of

A)total

A)individuals

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents