Scenario 13.2 Assume the following conditions hold. Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.

Now the Federal Reserve engages in an open market operation by purchasing $1 billion worth of government bonds from private bond dealers, who then deposit the $1 billion in the banks.This acts to lower the equilibrium interest rate by 2 percent.  Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

Refer to Scenario 13.1.What is the ultimate change in the money supply following the open market operation by the Fed?

A) -$3 billion

B) -$0.33 billion

C) +$1 billion

D) +$2.01 billion

E) +$5.2 billion

Correct Answer:

Verified

Q102: The Fed controls the money supply in

Q103: The Fed usually sets a higher reserve

Q104: In the figure given below panel A

Q105: As the velocity of money rises, the

Q106: Refer to Scenario 13.1.What is the change

Q108: The velocity of circulation of money is

Q109: The monetary policy decisions made by the

Q110: The Federal Reserve (Fed)was created by the

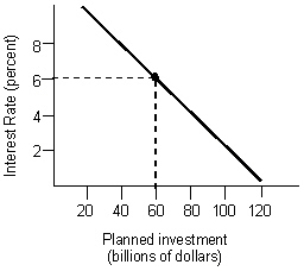

Q111: Scenario 13.1 Assume the following conditions hold.

Q112: All members of the Federal Board of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents