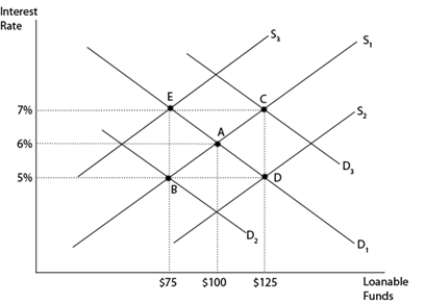

Figure 26-5.Figure 26-5 shows the loanable funds market for a closed economy.

-Refer to Figure 26-5.Starting at point A,the enactment of an investment tax credit would likely cause

A) the quantity of loanable funds traded to increase to $125 and the interest rate to rise to 7% (point C) .

B) the quantity of loanable funds traded to decrease to $75 and the interest rate to fall to 5% (point B) .

C) the quantity of loanable funds traded to decrease to $75 and the interest rate to rise to 7% (point E) .

D) the quantity of loanable funds traded to increase to $125 and the interest rate to fall to 5% (point D) .

Correct Answer:

Verified

Q139: If the demand for loanable funds shifts

Q140: As real interest rates fall,firms desire to

A)buy

Q141: At some point during the financial crisis

Q142: If the supply of and demand for

Q143: An increase in the quantity of loanable

Q145: Figure 26-5.Figure 26-5 shows the loanable funds

Q146: The first three elements of a financial

Q147: If there is a shortage in the

Q148: A decrease in government spending and the

Q149: The final element of a financial crisis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents