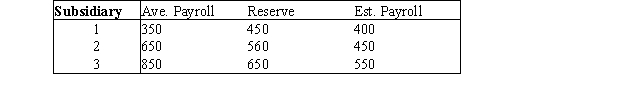

A Michigan company consists of three subsidiaries.Each has the respective average payroll,unemployment reserve fund,and estimated payroll shown in the table below (all figures are in millions of dollars).Any employer in the state of Michigan whose reserve to average payroll ratio is less than 1 must pay 25% of its estimated payroll in unemployment insurance premiums.Otherwise,if the ratio is at least one,the employer pays 13%.The company can aggregate its subsidiaries and label them as separate employers.For example,if subsidiaries 1 and 2 are aggregated,they must pay 25% of their combined payroll in unemployment insurance premiums.Determine which subsidiaries should be aggregated.

Correct Answer:

Verified

Q21: A global optimal solution is not necessarily

Q23: A local optimal solution is better than

Q32: For some types of integer programming problems,their

Q64: An auto company must meet (on time)

Q69: A company has daily staffing requirements for

Q75: An auto company produces cars at Los

Q76: A company supplies goods to three customers,

Q77: A company manufactures two products.If it charges

Q79: Each year, a computer company produces up

Q79: An electronic company is considering opening warehouses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents