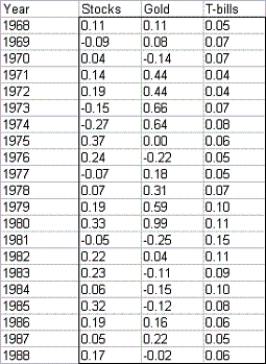

The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them.Suppose you are trying to determine what percentage of your money you should invest in T-bills,gold,and stocks.The table below lists the annual returns (percentage changes in value)for these investments for the years 1968-1988.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments,where the weights are the fractions of your money assigned to the investments.Suppose that the amount of each investment must be between 20% and 50% of the total invested.You would like the risk index of your portfolio to equal 0.15,and your goal is to maximize the expected return on your portfolio.Determine the maximum expected return on your portfolio,subject to the stated constraints.Use the average return earned by each investment during the years 1968-1988 as your estimate of expected return.

Correct Answer:

Verified

Q76: A manufacturer can sell product 1 at

Q80: Determine how to minimize the company's total

Q85: Discuss how the company's optimal production schedule

Q94: At time 0,you have $10,000.Investments A and

Q97: A company manufactures two products.If it charges

Q100: An oil company controls two oil fields.Field

Q101: The market manager is concerned about variability

Q102: A company produces three types of glue

Q103: The financial CEO is given a group

Q104: A total of 160 hours of labor

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents