Illustrate how GDS and TDS ratios as well as cash flow are important in calculating what size mortgage a person can afford.Use the following example to illustrate your conclusion.

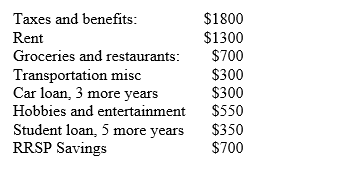

Hannah earns an annual salary of $72 000 and has following monthly expenses.

Hannah has $31 000 saved in her RRSP.There is a new condo development going up in her area and she hopes to be able to purchase her own place.The unit she has her heart set on costs $310 000 and they advertise a mortgage rate of 3.5%,compounded semi-annually,for this development.The property taxes will be $170 per month,heating costs $80,and condo fees $300.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q76: Lenders require Canada Mortgage and Housing Corporation

Q77: If you make an offer to the

Q78: Chuck obtained a mortgage of $90 000

Q79: Paying off an existing mortgage with a

Q80: A house is appraised at $298 000

Q81: Peter and Mary make a $25 000

Q82: Describe some of the advantages and disadvantages

Q84: Discuss in detail all of the factors

Q85: Indicate your assumptions and calculations and comment

Q86: Is purchasing a home an expense,an investment,or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents