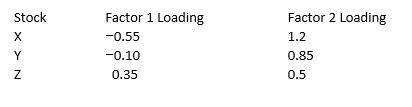

Refer to the following information. Consider the three stocks, stock X, stock Y and stock Z, that have the following factor loadings (or factor betas) . The expected prices one year from now for stocks X, Y, and Z are

The expected prices one year from now for stocks X, Y, and Z are

A) €53.55, €54.4, €55.25

B) €45.35, €54.4, €55.25

C) €55.55, €56.35, €57.15

D) €50, €50, €50

E) €51.35, €47.79, €51.58.

Correct Answer:

Verified

Q1: Refer to the information in the previous

Q3: Consider the following list of risk factors:

Q6: In one of their empirical tests of

Q7: In a microeconomic (or characteristic) based risk

Q8: Assume that you are embarking on a

Q9: To date, the results of empirical tests

Q34: The equation for the single-index market model

Q37: One approach for using multifactor models is

Q58: Consider a two-factor APT model where the

Q107: In the APT model the idea of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents