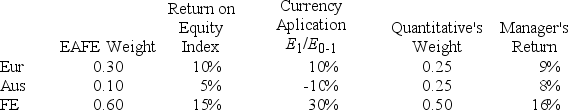

The manager of Quantitative International Fund uses EAFE as a benchmark. Last year's performance for the fund and the benchmark were as follows:

Calculate Quantitative's currency selection return contribution.

A) +20%

B) −5%

C) +15%

D) +5%

E) −10%

Correct Answer:

Verified

Q10: Assume there is a fixed exchange rate

Q10: The interest rate on a 1-year Canadian

Q22: The manager of Quantitative International Fund uses

Q25: The interplay between interest rate differentials and

Q25: As exchange rates change, they

A) change the

Q28: The manager of Quantitative International Fund uses

Q35: U.S. investors

A) can trade derivative securities based

Q39: International investing

A) cannot be measured against a

Q40: The EAFE is

A) the East Asia Foreign

Q72: When Country A's currency strengthens against Country

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents