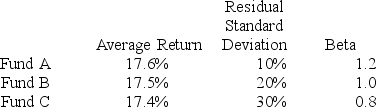

You want to evaluate three mutual funds using the Jensen measure for performance evaluation. The risk-free return during the sample period is 6%, and the average return on the market portfolio is 18%. The average returns, standard deviations, and betas for the three funds are given below.

The fund with the highest Jensen measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Correct Answer:

Verified

Q9: Suppose the risk-free return is 3%. The

Q17: Suppose the risk-free return is 4%. The

Q24: The following data are available relating to

Q25: Suppose you purchase one share of the

Q25: The following data are available relating to

Q25: Suppose you own two stocks, A and

Q30: You want to evaluate three mutual funds

Q32: You want to evaluate three mutual funds

Q38: Suppose you purchase one share of the

Q40: Suppose you purchase one share of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents