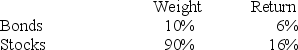

In a particular year, Aggie Mutual Fund earned a return of 15% by making the following investments in the following asset classes:

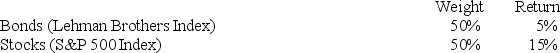

The return on a bogey portfolio was 10%, calculated as follows:

The contribution of asset allocation across markets to the total excess return was

A) 1%.

B) 3%.

C) 4%.

D) 5%.

E) 6%

Correct Answer:

Verified

Q61: The _ measures the reward to volatility

Q64: Risk-adjusted mutual fund performance measures have decreased

Q66: The Sharpe, Treynor, and Jensen portfolio performance

Q67: A pension fund that begins with $500,000

Q69: The Value Line Index is an equally-weighted

Q70: In measuring the comparative performance of different

Q71: In a particular year, Aggie Mutual Fund

Q72: The Jensen portfolio evaluation measure

A) is a

Q74: A portfolio manager's ranking within a comparison

Q75: The dollar-weighted return on a portfolio is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents