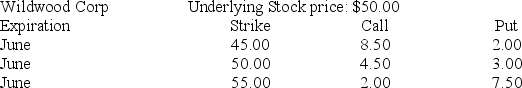

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

If in June the stock price is $53, your net profit on the bull money spread (buy the 45 call and sell the 55 call) would be ________.

A) $300

B) −$400

C) $150

D) $50

Correct Answer:

Verified

Q48: _ is the most risky transaction to

Q49: A "bet" option is also called a

Q50: You are cautiously bullish on the common

Q51: Which one of the following is a

Q52: Which of the following expressions represents the

Q54: The potential loss for a writer of

Q55: You sell one Huge-Packing August 50 call

Q56: A writer of a call option will

Q57: A European put option gives its holder

Q58: A put on Sanders stock with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents