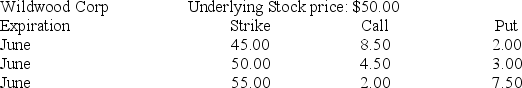

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Suppose you establish a bullish money spread with the puts. In June the stock's price turns out to be $52. Ignoring commissions, the net profit on your position is ________.

A) $500

B) $700

C) $200

D) $250

Correct Answer:

Verified

Q67: You sell one MBI July 90 call

Q68: You are convinced that a stock's price

Q69: The common stock of the Avalon Corporation

Q70: Which of the following strategies makes a

Q71: Which of the following strategies makes a

Q73: The common stock of the Avalon Corporation

Q74: What strategy is designed to ensure a

Q75: The common stock of the Avalon Corporation

Q76: The common stock of the Avalon Corporation

Q77: Which strategy benefits from upside price movement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents