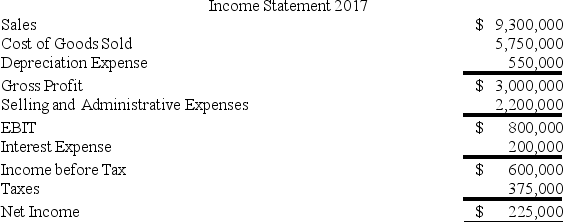

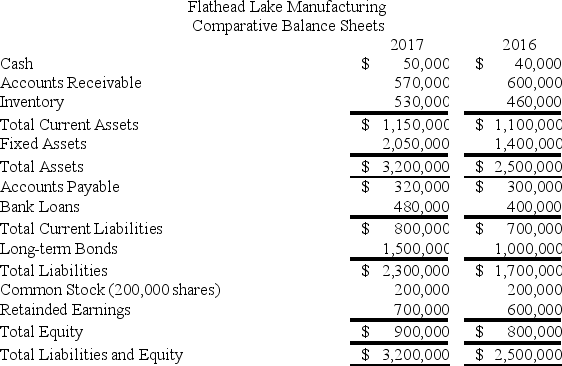

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The industry average ACP is 32 days. How is Flathead doing in its collections relative to the industry? (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) Flathead's receivables are outstanding about 9 fewer days than the industry average.

B) Flathead's receivables are outstanding about 15 fewer days than the industry average.

C) Flathead's receivables are outstanding about 12 more days than the industry average.

D) Flathead's receivables are outstanding about 6 more days than the industry average.

Correct Answer:

Verified

Q17: Many observers believe that firms "manage" their

Q18: If the interest rate on debt is

Q19: Operating ROA is calculated as _, while

Q20: Cash Flow Data for Interceptors, Inc.

Q21: The financial statements of Burnaby Mountain Trading

Q23: If a firm has a positive tax

Q24: The financial statements of Flathead Lake Manufacturing

Q25: The financial statements of Flathead Lake Manufacturing

Q26: Economic value added (EVA) is

A) the difference

Q27: The financial statements of Flathead Lake Manufacturing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents