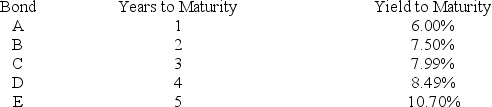

$1,000 par value zero-coupon bonds (ignore liquidity premiums)

One year from now bond C should sell for ________ (to the nearest dollar) .

A) $857

B) $894

C) $835

D) $821

Correct Answer:

Verified

Q50: A coupon bond that pays interest annually

Q51: Consider the following $1,000 par value zero-coupon

Q52: Analysis of bond returns over a multiyear

Q53: Consider the following $1,000 par value zero-coupon

Q54: You can be sure that a bond

Q56: $1,000 par value zero-coupon bonds (ignore liquidity

Q57: A Treasury bond due in 1 year

Q58: Consider the following $1,000 par value zero-coupon

Q59: Yields on municipal bonds are typically _

Q60: Which of the following bonds would most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents