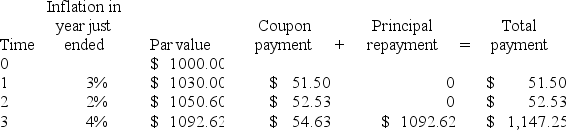

Consider a newly issued TIPS bond with a 3-year maturity, par value of $1,000, and coupon rate of 5%. Assume annual coupon payments.

What is the nominal rate of return on the TIPS bond in the first year?

A) 5%

B) 5.15%

C) 8.15%

D) 9%

Correct Answer:

Verified

Q72: A corporate bond has a 10-year maturity

Q73: Assuming semiannual compounding, a 20-year zero coupon

Q74: One-, two-, and three-year maturity, default-free, zero-coupon

Q75: Consider a 7-year bond with a 9%

Q76: The yield to maturity on a bond

Q78: If the quote for a Treasury bond

Q79: On May 1, 2007, Joe Hill is

Q80: Under the pure expectations hypothesis and constant

Q81: A bond was purchased at a premium

Q82: The price of a bond (with par

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents