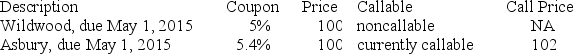

On May 1, 2007, Joe Hill is considering one of the following newly issued 10-year AAA corporate bonds.

Suppose market interest rates decline by 100 basis points (i.e., 1%) . The effect of this decline would be ________.

A) the price of the Wildwood bond would decline by more than the price of the Asbury bond

B) the price of the Wildwood bond would decline by less than the price of the Asbury bond

C) the price of the Wildwood bond would increase by more than the price of the Asbury bond

D) the price of the Wildwood bond would increase by less than the price of the Asbury bond

Correct Answer:

Verified

Q63: A 6% coupon U.S. Treasury note pays

Q64: A bond pays a semiannual coupon, and

Q65: A bond has a flat price of

Q66: The yield to maturity of a 10-year

Q67: If the price of a $10,000 par

Q69: Yields on municipal bonds are generally lower

Q70: If the quote for a Treasury bond

Q71: On May 1, 2007, Joe Hill is

Q72: A corporate bond has a 10-year maturity

Q73: Assuming semiannual compounding, a 20-year zero coupon

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents