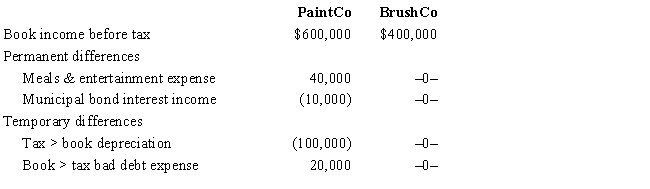

PaintCo Inc., a domestic corporation, owns 100% of BrushCo Ltd., an Irish corporation. Assume that the U.S. corporate tax rate is 35% and the Irish rate is 15%. PaintCo is permanently reinvesting BrushCo's earnings outside the United States under ASC 740-30 (APB 23). The corporations' book income, permanent and temporary book-tax differences, and current tax expense are reported as follows. There is no valuation allowance, and the effective tax rates do not change. Determine PaintCo's total tax expense reported on its GAAP financial statements, its current tax expense (benefit), and its deferred tax expense (benefit).

Correct Answer:

Verified

Q42: Van Dyke, Inc., hopes to report a

Q43: Beach, Inc., a domestic corporation, owns 100%

Q44: Which of the following items is not

Q45: Ursula, Inc. is a domestic corporation. It

Q45: Beach, Inc., a domestic corporation, owns 100%

Q50: Which of the following items are not

Q52: South, Inc., earns book net income before

Q56: Never, Inc., earns book net income before

Q57: South, Inc., earns book net income before

Q58: Cold, Inc., reported a $100,000 total tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents