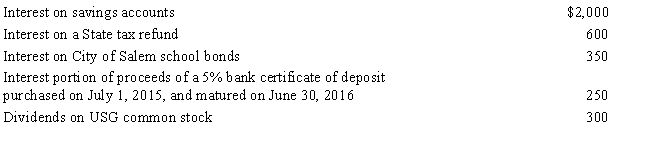

George, an unmarried cash basis taxpayer, received the following amounts during 2016:

What amount should George report as gross income from dividends and interest for 2016?

A) $2,300.

B) $2,550.

C) $3,150.

D) $3,500.

E) None of these.

Correct Answer:

Verified

Q41: Iris collected $150,000 on her deceased husband's

Q43: Turquoise Company purchased a life insurance policy

Q50: Under the original issue discount (OID) rules

Q64: Teal company is an accrual basis taxpayer.On

Q77: Darryl,a cash basis taxpayer,gave 1,000 shares of

Q84: Sarah, a majority shareholder in Teal, Inc.,

Q89: On January 1, Father (Dave) loaned Daughter

Q91: The effects of a below-market loan for

Q92: In December 2016,Todd,a cash basis taxpayer,paid $1,200

Q98: Tonya is a cash basis taxpayer.In 2016,she

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents