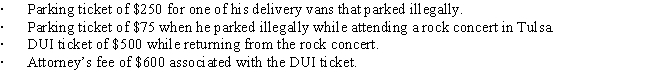

Andrew, who operates a laundry business, incurred the following expenses during the year.

What amount can Andrew deduct for these expenses?

A) $0.

B) $250.

C) $600.

D) $1,425.

E) None of the above.

Correct Answer:

Verified

Q21: A taxpayer may elect to use the

Q33: Goodwill associated with the acquisition of a

Q37: A purchased trademark is a § 197

Q40: Heron Corporation, a calendar year C corporation,

Q49: Hazel purchased a new business asset (five-year

Q62: Which of the following may be deductible?

A)Bribes

Q62: Ivory, Inc., has taxable income of $600,000

Q72: Regarding research and experimental expenditures, which of

Q74: Tommy, an automobile mechanic employed by an

Q81: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents