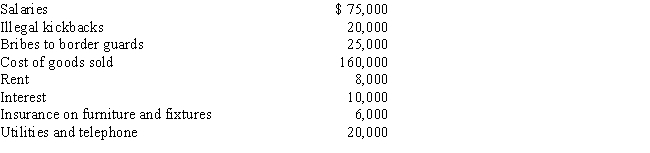

Tom operates an illegal drug-running operation and incurred the following expenses:

Which of the above amounts reduces his taxable income?

A) $0.

B) $160,000.

C) $279,000.

D) $324,000.

E) None of the above.

Correct Answer:

Verified

Q41: On June 1 of the current year,

Q49: Hazel purchased a new business asset (five-year

Q54: Tan Company acquires a new machine (ten-year

Q57: James purchased a new business asset (three-year

Q62: Ivory, Inc., has taxable income of $600,000

Q67: Which of the following statements is correct

Q74: Tommy, an automobile mechanic employed by an

Q76: Iris,a calendar year cash basis taxpayer,owns and

Q81: Which of the following is not a

Q85: Cream, Inc.'s taxable income for the current

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents