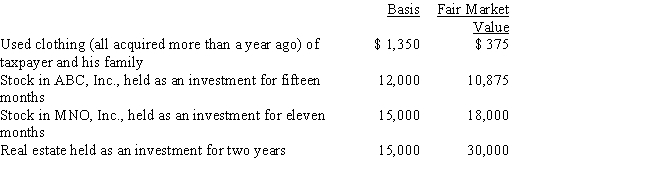

Zeke made the following donations to qualified charitable organizations during the year:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University. Both are qualified charitable organizations. Disregarding percentage limitations, Zeke's charitable contribution deduction for the year is:

A) $43,350.

B) $56,250.

C) $59,250.

D) $60,375.

E) None of the above.

Correct Answer:

Verified

Q42: White Company acquires a new machine (seven-year

Q47: Bonnie purchased a new business asset (five-year

Q58: Diane purchased a factory building on April

Q68: George purchases used seven-year class property at

Q76: On March 1,2016,Lana leases and places in

Q79: On May 2,2016,Karen placed in service a

Q89: During the past two years, through extensive

Q123: During the current year, Owl Corporation (a

Q125: During the current year, Ralph made the

Q127: During the current year, Owl Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents