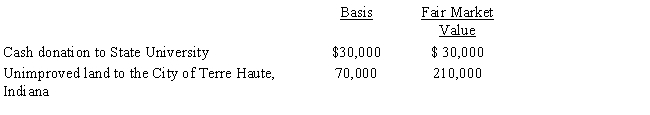

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of the above.

Correct Answer:

Verified

Q47: In the current year, Plum Corporation, a

Q61: Pink,Inc.,a calendar year C corporation,manufactures golf gloves.For

Q62: Pat purchased a used five-year class asset

Q68: George purchases used seven-year class property at

Q73: On June 1,2016,Red Corporation purchased an existing

Q77: Which of the following is not a

Q78: During 2014,the first year of operations,Silver,Inc. ,pays

Q81: Which of the following is not a

Q125: During the current year, Ralph made the

Q127: During the current year, Owl Corporation (a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents