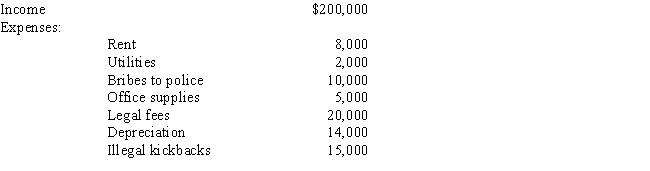

Kitty runs a brothel (illegal under state law) and has the following items of income and expense. What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: Tom purchased and placed in service used

Q85: On August 20,2016,May placed in service a

Q86: Nora purchased a new automobile on July

Q94: Alfred's Enterprises, an unincorporated entity, pays employee

Q96: Rustin bought used 7-year class property on

Q97: On July 15,2016,Mavis paid $275,000 for improvements

Q112: Can a trade or business expense be

Q119: While she was a college student,Angel lived

Q158: In 2016, Tan Corporation incurred the following

Q159: During the current year, Gray Corporation, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents