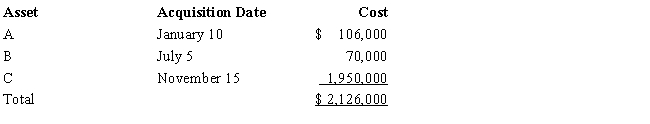

Audra acquires the following new five-year class property in 2016:

Audra elects § 179 treatment for Asset C. Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra claims the full available additional first-year depreciation deduction. Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Rod paid $1,950,000 for a new warehouse

Q83: Polly purchased a new hotel on July

Q85: On August 20,2016,May placed in service a

Q86: Nora purchased a new automobile on July

Q90: On April 15,2016,Sam placed in service a

Q93: On March 3,2016,Sally purchased and placed in

Q96: Rustin bought used 7-year class property on

Q97: On December 28,2015,the board of directors of

Q112: Can a trade or business expense be

Q169: Martin is a sole proprietor of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents